Struggling to divide your ad budget between Amazon and Walmart? You’re not alone. In today’s e-commerce landscape, mastering both platforms isn’t optional—it’s essential for sustainable growth.

While both offer powerful advertising tools, their fundamental differences require platform-specific strategies.

Here’s what’s working now, what’s different, and how to position your brand for success on both platforms in 2025.

Table of Contents

- Where Amazon and Walmart Advertising Align: The Common Ground

- Critical Differences: Why Your Strategy Must Adapt to Each Platform

- Platform-Specific Advertising Strategies for 2025

- Walmart: Growing Platform with Unique Advantages

- Budget Allocation Framework for Dual-Platform Success

- Performance Measurement: Different Metrics for Different Platforms

- Looking Ahead: Emerging Trends to Watch

- How Eva Can Supercharge Your Multi-Platform Success

- The Bottom Line

- Frequently Asked Questions: Walmart vs. Amazon Advertising

- Amazon-Specific Questions

- Walmart-Specific Questions

Where Amazon and Walmart Advertising Align: The Common Ground

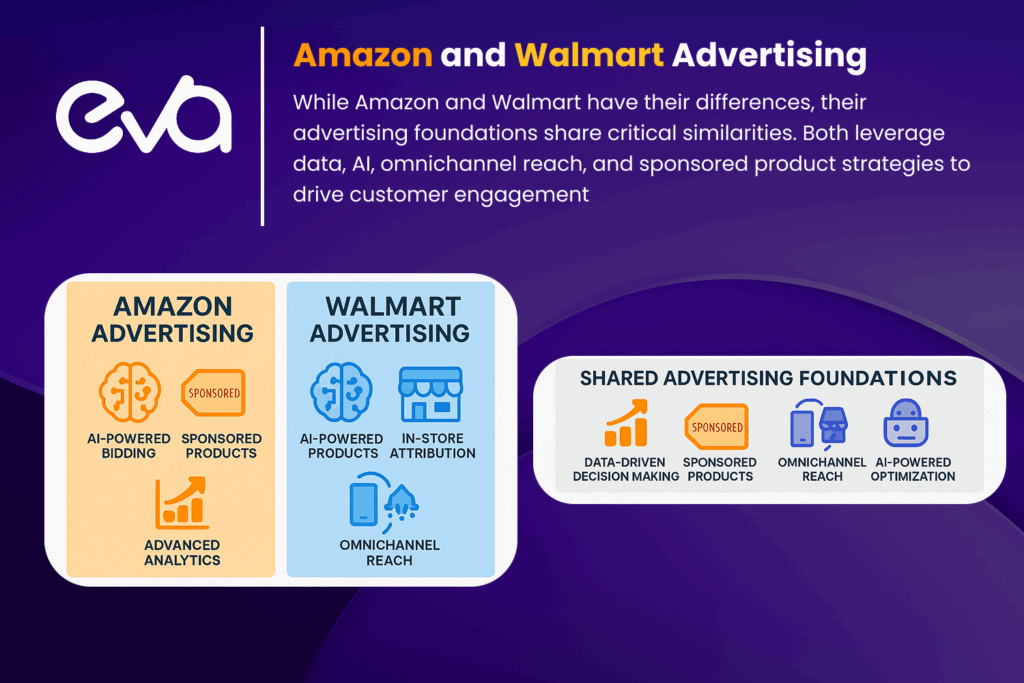

Data-Driven Decision Making Is Non-Negotiable

Both platforms operate on data intelligence:

- Amazon leverages its Amazon Marketing Cloud (AMC) for deep customer behavior insights

- Walmart Connect uses its first-party data network, combining online and in-store purchase patterns

What This Means For You: Stop guessing. Let data guide your ad spend decisions. Analyze performance metrics weekly and adjust campaigns accordingly.

Sponsored Products Remain the Foundation

On both platforms, Sponsored Product ads deliver the highest ROI:

- Amazon Sponsored Products appear in search results and on product pages

- Walmart Sponsored Products function similarly, placing products in prime positions

What This Means For You: Allocate 60-70% of your advertising budget to Sponsored Products to maximize visibility when purchase intent is highest.

Omnichannel Reach Is Expanding

Both platforms now extend beyond their websites:

- Amazon integrates advertising across Prime Video, Twitch, and off-site displays

- Walmart connects online advertising with in-store displays and Walmart+ partnerships

What This Means For You: Create consistent messaging across all available ad formats to reinforce your brand at multiple touchpoints.

AI-Powered Optimization

Artificial intelligence has transformed campaign management:

- Amazon’s AI tools optimize bidding, suggest keywords, and help generate ad creatives

- Walmart’s machine learning identifies high-performing placements and adjusts bids automatically

What This Means For You: Use automation for tactical execution, but maintain strategic oversight to ensure AI aligns with your business goals.

Critical Differences: Why Your Strategy Must Adapt to Each Platform

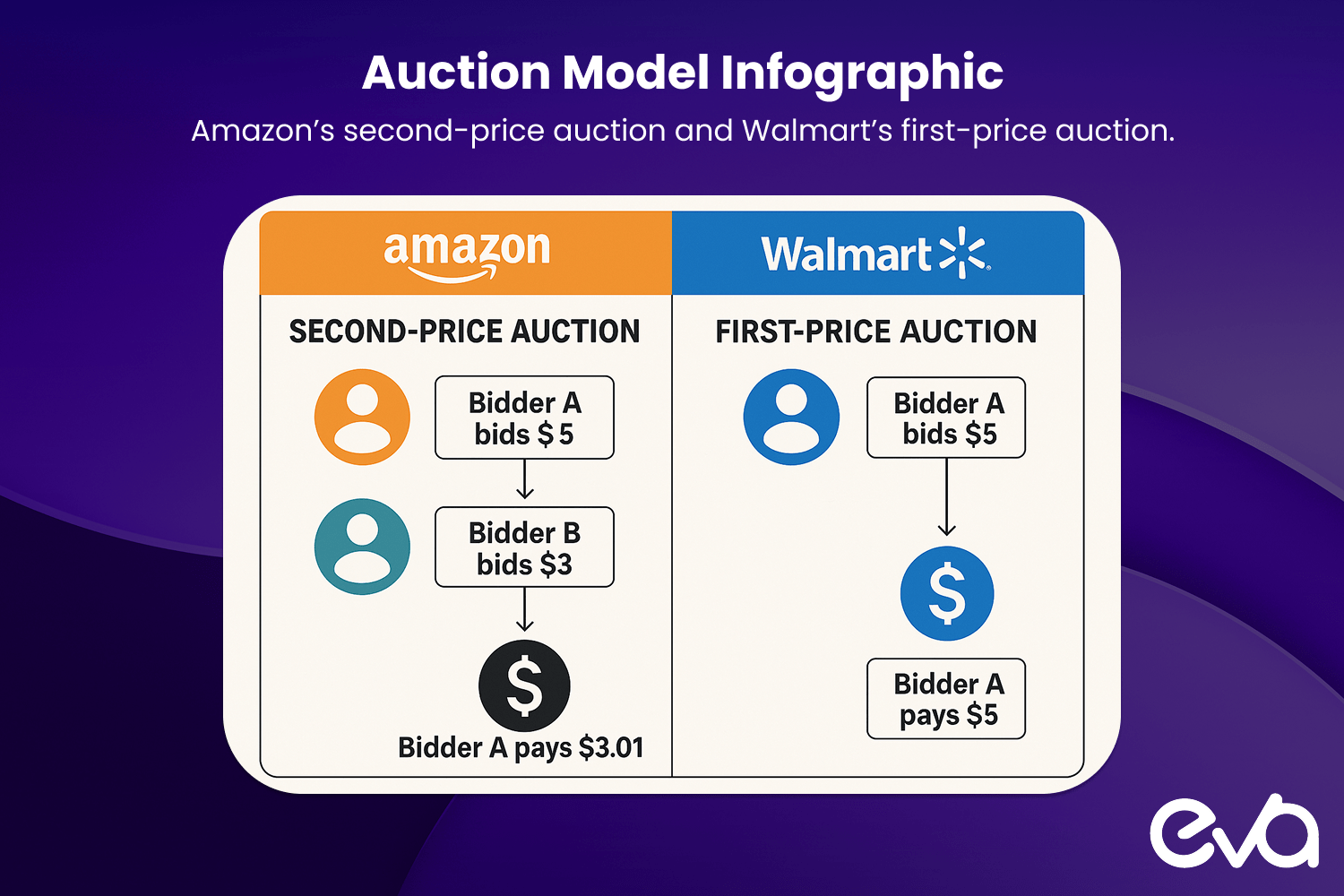

Auction Models & Pricing Structure

The way you bid for ad placements differs significantly:

- Amazon uses a second-price auction model—you pay just $0.01 more than the next highest bidder

- Walmart employs a first-price auction—you pay exactly what you bid

What This Means For You: On Walmart, bid more conservatively and test incrementally. On Amazon, bid more aggressively knowing you’ll rarely pay your maximum bid.

Competitive Landscape & Private Label Dynamics

The competitive environment varies substantially:

- Amazon competes directly with sellers through extensive private label brands

- Walmart has fewer private label conflicts, making it potentially easier to gain visibility

What This Means For You: On Amazon, invest in brand defense campaigns. On Walmart, emphasize your unique value proposition and quality standards.

Targeting Capabilities & Campaign Controls

Control levels differ between platforms:

- Amazon offers advanced targeting options, including negative keywords and product attribute targeting

- Walmart provides fewer targeting options but unique placement opportunities like Search Brand Amplifier

What This Means For You: On Amazon, build granular campaign structures with tight keyword control. On Walmart, focus on broader category targeting and strategic placement.

Pricing Strategy & Customer Expectations

Shopping motivations differ between customer bases:

- Amazon shoppers often prioritize convenience, Prime benefits, and reviews over lowest prices

- Walmart customers typically expect Everyday Low Prices (EDLP) and may be more price-sensitive

What This Means For You: Adjust your strategies accordingly—emphasize value and service on Amazon, highlight competitive pricing on Walmart.

Platform-Specific Advertising Strategies for 2025

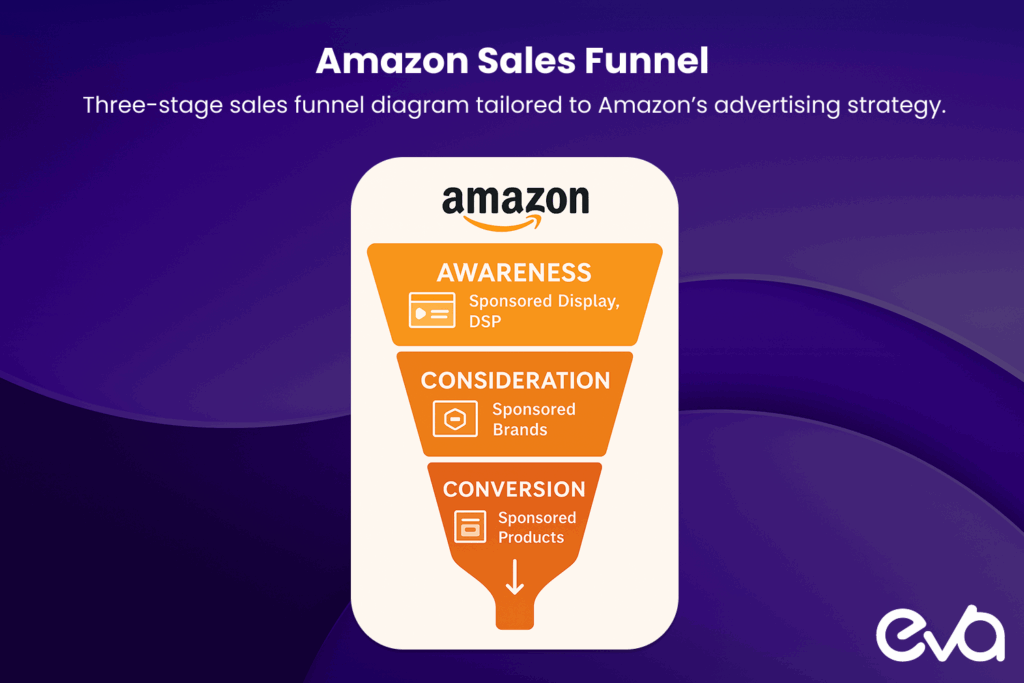

Amazon: Leveraging Advanced Features for Maximum Impact

1. Full-Funnel Advertising Approach

- Sponsored Display and DSP for brand awareness

- Use Sponsored Brands for mid-funnel consideration

- Close with Sponsored Products for high-intent shoppers

2. Video Content Integration

- Incorporate Amazon’s expanding video ad formats

- Create shoppable video experiences that blend entertainment with direct purchase paths

3. Amazon Marketing Cloud Insights

- Use AMC to analyze cross-channel performance

- Develop audience segments based on actual purchase behavior, not just browsing history

4. Optimize for Amazon’s Algorithm

- Focus on external traffic, organic engagement, and sales velocity

- Build a robust review strategy to improve conversion rates

Walmart: Growing Platform with Unique Advantages

1. Retail Media Network Expansion

- Leverage Walmart’s expanding ecosystem including in-store displays

- Utilize Search Brand Amplifier to dominate key search terms

2. Seasonal Campaign Planning

- Align with Walmart’s promotional calendar, which often starts earlier than competitors

- Create exclusive offers for Walmart+ members to build platform loyalty

3. First-Party Data Connections

- Connect online campaigns with in-store purchase data for closed-loop measurement

- Target high-value segments based on Walmart’s consumer insights

4. Cost-Effective Entry Strategy

- Take advantage of generally lower CPCs compared to Amazon

- Test new product launches with controlled budget experiments

Budget Allocation Framework for Dual-Platform Success

For brands selling on both platforms, strategic budget allocation is crucial:

For Established Brands (Annual Revenue $1M+)

Amazon: 65-75% of total ad budget

- 60% Sponsored Products

- 25% Sponsored Brands/Video

- 15% DSP or Streaming TV Ads

Walmart: 25-35% of total ad budget

- 70% Sponsored Products

- 20% Search Brand Amplifier

- 10% Display Ads

For Growing Brands (Annual Revenue <$1M)

Amazon: 70-80% of total ad budget

- 75% Sponsored Products

- 20% Sponsored Brands

- 5% Experimental Formats

Walmart: 20-30% of total ad budget

- 80% Sponsored Products

- 20% Search Brand Amplifier

Performance Measurement: Different Metrics for Different Platforms

Tracking success requires platform-specific KPIs:

Amazon Performance Metrics to Monitor

- ACOS (Advertising Cost of Sale)

- TACOS (Total Advertising Cost of Sale)

- New-to-Brand Purchases

- Share of Voice

- Branded vs. Non-Branded Conversion Rates

Walmart Performance Metrics to Focus On

- ROAS (Return on Ad Spend)

- Attributed Sales Increase

- In-Store Impact (for relevant categories)

- Search Rank Improvements

- Add to Cart Rate

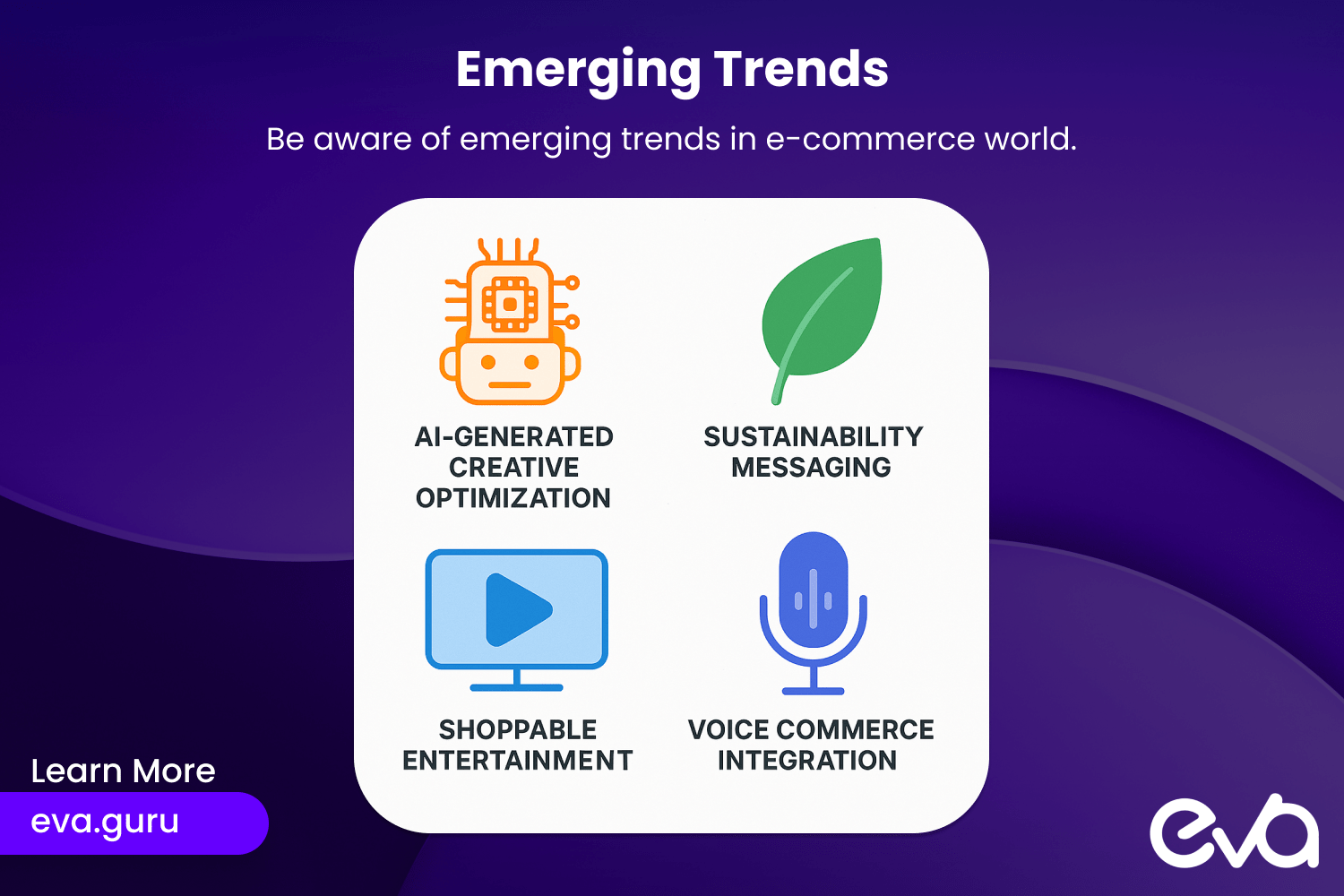

Looking Ahead: Emerging Trends to Watch

As we move through 2025, several key trends are reshaping e-commerce advertising:

1. AI-Generated Creative Optimization

- Both platforms are rapidly integrating generative AI to improve ad creative

- Automated testing of multiple variants will become standard practice

2. Sustainability Messaging

- Eco-conscious shoppers are influencing algorithm development

- Both platforms will reward brands with authentic sustainability credentials

3. Shoppable Entertainment

- The lines between content and commerce continue to blur

- Interactive and shoppable ads will dominate premium placements

4. Voice Commerce Integration

- Voice search optimization will impact advertising effectiveness

- New ad formats designed specifically for voice-initiated shopping

How Eva Can Supercharge Your Multi-Platform Success

At Eva, we understand the complexities of advertising on both Amazon and Walmart. Our integrated AI platform and e-commerce expertise help you navigate both ecosystems with data-driven precision.

Our Platform Delivers Results Through:

1. AI-Powered Hourly Bid Optimization

- Our technology makes real-time, data-driven bid adjustments throughout the day

- Eva AI manages complex bidding scenarios across both platforms, executing tasks that would be impossible to achieve manually

2. Comprehensive Profit Analytics

- Gain visibility into true profitability across all your advertising efforts

- Track and analyze platform-specific metrics to inform smarter decisions

3. Inventory-Aware Advertising

- Prevent wasted ad spend by automatically adjusting campaigns based on inventory levels

- Synchronize your advertising strategy with product availability for maximum efficiency

4. Expert-Driven Strategy Development

- Our specialists bring deep category knowledge to both Amazon and Walmart campaigns

- We identify competitive opportunities unique to each platform’s ecosystem

Proven Results Across Both Platforms:

- 51% Average Increase in Profits through optimized advertising strategies

- $1.6+ Billion in ad spend optimized across all marketplaces

- 40% Reduction in Operational Costs through improved efficiency

The Bottom Line

Success in today’s e-commerce landscape requires nuanced understanding of both Amazon and Walmart’s advertising ecosystems. By recognizing where these platforms align and where they diverge, you can craft targeted strategies that maximize returns on each platform.

What works on Amazon won’t automatically succeed on Walmart, and vice versa. The key is adapting your approach while maintaining consistent brand messaging and leveraging the unique strengths of each platform.

Whenever you’re ready, here are two ways we can help you implement these strategies:

- Claim a Free Audit & Forecast: Our experts will analyze your business across both platforms and craft a profitable growth plan.

- Start with Eva’s AI Platform: Access enterprise-level technology that delivers smart advertising optimization, profit analytics, and competitive intelligence for your e-commerce business.

Frequently Asked Questions: Walmart vs. Amazon Advertising

Start with the platform where you have a stronger sales history. If you’re equal in both, Amazon typically offers more robust analytics for beginners and a larger customer base. Once you’ve established your advertising fundamentals on one platform, expand to the other using the platform-specific strategies outlined above.

Begin with 8-10% of your total revenue on each platform. The most successful brands eventually scale to 15-20% on Amazon and 10-15% on Walmart, but only after establishing profitable campaigns with positive ROAS. Start small, measure results, and scale gradually based on performance.

No. While your brand messaging should remain consistent, your creative execution should be platform-specific. Amazon shoppers respond to feature-rich, benefit-focused content, while Walmart customers are more responsive to value-oriented messaging and competitive pricing callouts. Adapt your creative assets accordingly.

Weekly reviews are the minimum, but daily monitoring is recommended. Amazon’s competitive landscape changes rapidly, often requiring multiple adjustments per week. Walmart tends to be slightly less volatile, but still requires regular optimization, particularly around promotional events and seasonal peaks.

Amazon-Specific Questions

How does Amazon’s algorithm impact my advertising performance?

The Amazon algorithm weighs organic ranking factors heavily when determining ad placements. Unlike earlier versions, the newest version of Amazon’s algorithm prioritizes:

- Sales velocity and consistency

- External traffic sources (off-Amazon)

- Organic click-through rates

- Conversion rates on your product pages

Optimize both your organic listing quality and your ad campaigns for maximum effectiveness.

Are Amazon DSP ads worth the investment for smaller brands?

For brands under $1M in annual revenue, DSP might not be the right starting point. Focus first on maxing out the potential of Sponsored Products and Sponsored Brands. Once you reach ACOS plateaus on these formats, then consider testing modest DSP budgets (starting at $5K-10K) with retargeting campaigns specifically.

How can I defend against Amazon’s private label competition?

Brand defense requires a multi-faceted approach:

- Bid aggressively on your own brand terms

- Create Sponsored Brands campaigns that showcase your brand story and unique value proposition

- Develop A+ content that builds customer loyalty

- Focus on product differentiation through unique features, warranties, or service components

Walmart-Specific Questions

How does Walmart’s in-store presence affect online advertising strategy?

Walmart’s unique advantage is its ability to connect online and offline shopping behaviors. For products sold in both channels:

- Use Search Brand Amplifier to boost visibility for high-margin items

- Create store-specific promotional codes that can be tracked across channels

- Develop campaigns around key in-store seasonal moments

- Align digital advertising with in-store merchandising promotions

Are Walmart’s advertising costs really lower than Amazon’s?

Yes, in most cases. Average CPCs on Walmart are typically 30-50% lower than equivalent placements on Amazon. However, conversion rates are often lower as well, so the overall ROI may be comparable. The real opportunity lies in Walmart’s less competitive categories, where early movers can secure prominent placements at favorable rates.

How important is the Walmart+ customer for advertisers?

Extremely important. Walmart+ members shop more frequently and spend more per order than non-members. This subscription program is still growing, but creating exclusive offers for these high-value customers is already showing strong ROAS for brands that target them specifically with enhanced deals and early access promotions.